AI, Aging Millennials, and Asset Tokenization: What trends will define financial services in the decade to come?

The signal in the noise: which trends matter?

Foresight-mature organizations, those that are really, truly future-proof, scan widely for trends and strictly manage them. To do so, they typically use a tool such as a trends radar to visualize, prioritize, and finally feed relevant trends into their strategy and innovation activities. But how to filter and prioritize identified trends in the first place? One method we use is a straightforward mapping exercise where we evaluate trends based on two parameters: impact and uncertainty. At the RH FutureAtelier we crowdsourced opinions to work with a variant of this exercise: impact and certainty:

● Impact: what impact do you expect this trend to have on your industry?

● Certainty: how certain are you about the evolution and/or trajectory of this trend towards reaching its impact?

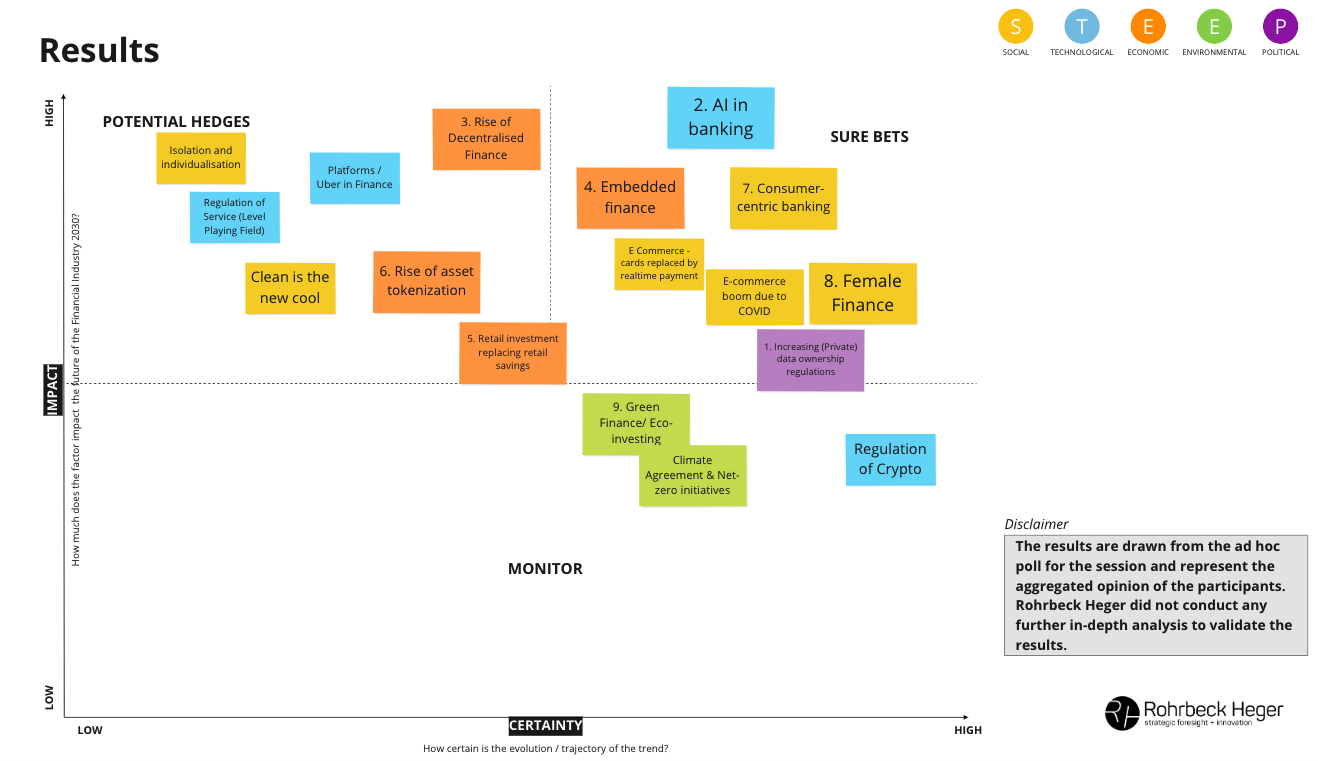

To give participants a taste of what it’s like to put this methodology into practice, we polled all those present at the FutureAtelier event to evaluate the nine trends we identified for the financial services and insurance sector. We then mapped the results on a graph and participants split into two breakout groups to discuss the results.

An Impact-Certainty Assessment of Trends in the Financial Services Sector

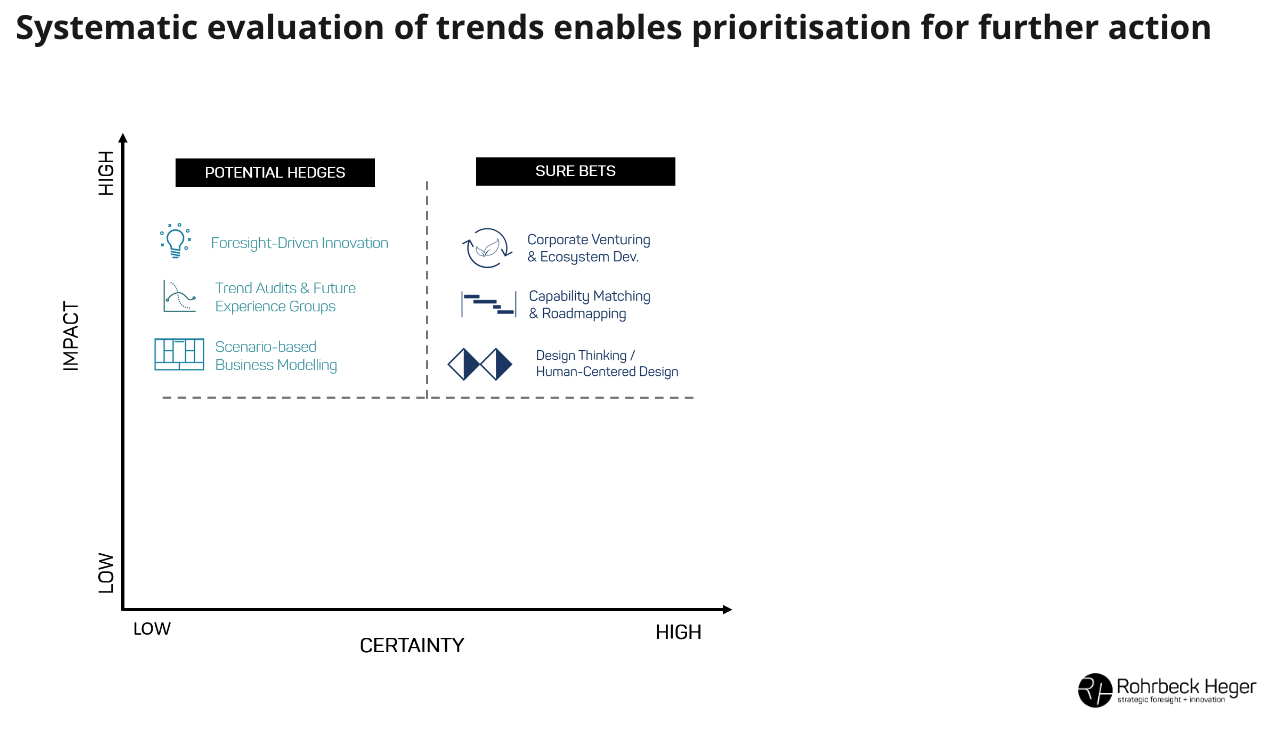

To understand the map below (Fig. 2), we divide it into four quadrants. At the top left, we have the high impact/low certainty trends, which we call our “hedged risks.” These trends, potential threats and opportunities, require further research, thinking, and testing before being introduced into a strategy roadmap, for example. In contrast, those high impact/high certainty items show trends that we call “sure bets,” and should be quickly acted upon, directly incorporated into strategy. So, which were the “sure bets” and “hedged risks” among our top nine trends in the financial services and insurance sectors (Fig.3)?

Figure 2: Prioritizing trends

Figure 3: Results from our 2nd RH FutureAtelier on Financial Services

Based on what we see in Fig. 3, our crowdsourced “impact/certainty” matrix determined that AI, consumer-centric banking, more women in finance, embedded finance, e-commerce boom due to COVID, card-based transactions replaced by real-time payments, and increasing (private) data ownership regulations will be the seven trends to classify as “safe bets”—that is to say, these trends rank as both high impact and high certainty. (Participants had the option to name their own trends in addition to the nine we originally identified.) While both regulation of cryptocurrency and climate change-specific trends (climate agreements, net-zero initiatives, green finance, and eco-investing) were rated as relatively certain to happen, they fell short of convincing the group of their high impact on the financial services and insurance sectors. We at Rohrbeck Heger were surprised by this result and would challenge this assessment. Considering how deeply most financial services, especially investment, are intertwined with the availability and flow of natural resources, the massive shifts we anticipate as a result of pressures to mitigate climate change (not to mention potential natural disasters, including pandemics) will have a great effect on the industry.

Foresight: making it work for you

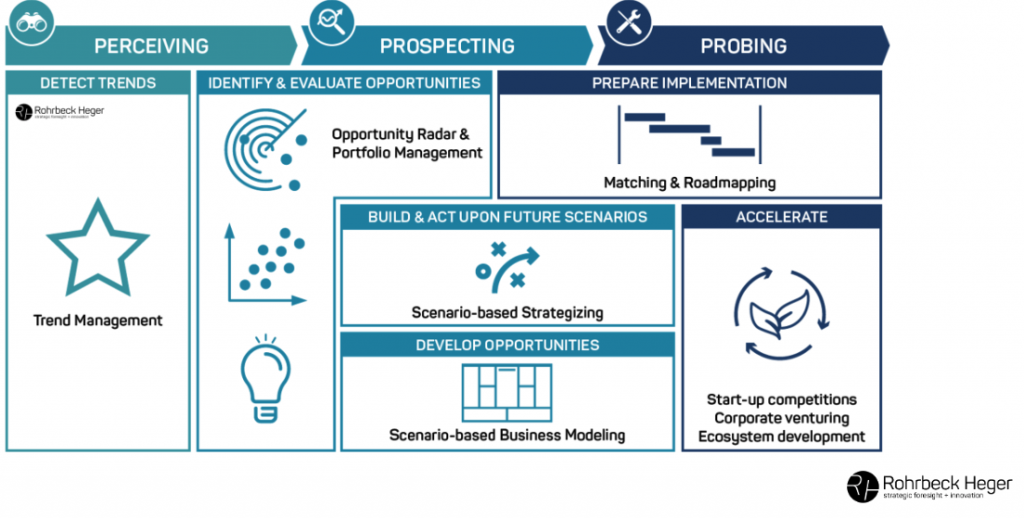

It’s vital to evaluate what trends mean for an organization and to filter and prioritize what happens next. Rohrbeck Heger advises on several methods to derive insights and define actions using foresight.

But in general, we advise that our clients do four things in executing a foresight process:

- Collaborate and co-create. Bring together dissimilar opinions to develop true insights and challenge conventions. No-one has a monopoly on understanding the future.

- Structure it. The future is uncertain, but it doesn’t have to be unmanageable. Use tools like radars and decision portfolios to drive the discussion forward and keep it action-oriented.

- Prioritize. Recognize that you can’t do everything all at once. Bring wisdom to bear and decide on what is a ‘“sure bet” or a “hedged risk.”

- Commit to the longer-term. Ensure that key trends are addressed in your strategy processes and innovation activities. To take a long-term view, it helps to build scenarios to immerse your teams in ‘future worlds’ where they can imagine and grasp what a future world looks like.

Foresight in action: A new way of thinking at die Mobiliar

Our RH FutureAtelier event with a focus on financial services and insurance concluded with a thoughtful talk given by Maren Kottler, Head of Corporate Foresight at die Mobiliar, Switzerland’s oldest insurance provider. She shared her team’s journey in recent years as they replaced an older internal trend process with a new, more comprehensive foresight approach; one that better leverages both the breadth and depth of such a large and complex organization.

“When the forecast is showing rain, you take an umbrella with you in the morning,” explained Kottler. “But how do you prepare your company for different seasons, like economical thunderstorms or technological flooding?” As the head of die Mobiliar’s Corporate Foresight team, wrestling with big, unwieldy questions such as these are just another day at the office. “For us, thinking about the future means thinking about uncertainties…it’s a game of thoughts. It’s the introduction of new perspectives and new insights.” The company’s approach to innovation strategy was due for an update, and in 2019 Kottler’s team introduced a semi-automated platform to explore possible futures. “Everybody in our company has access to add a new inspiration,” explained Kottler, describing the platform. “We want to bring the future to everyone’s desk.”