How can you apply foresight in Business Model Innovation?

You have heard that you need to be ready to change, refine and innovate your business model. You know that this is key to staying competitive. You know that the business model needs to be different from the ones of your peers in order to yield superior performance.

And now you’re wondering how you should go about it?

In this article, I share some insights from the academic side of Rohrbeck Heger.

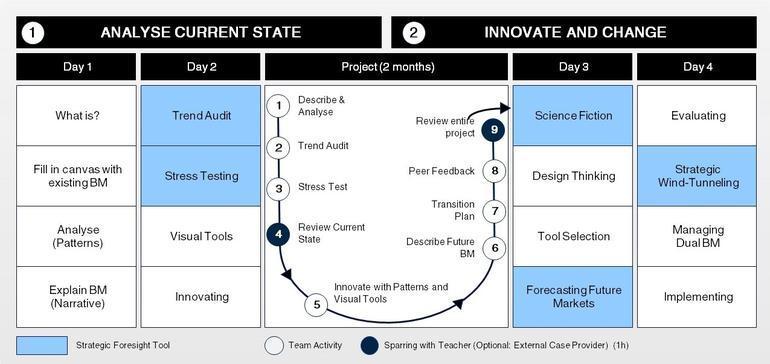

In the MBA and EMBA classes at EDHEC, where I am Director at the Chair for Foresight, Innovation & Transformation, we have created a game plan that takes you all the way from analyzing your current business, to stress testing and innovating it. The figure below shows how we enhanced classical business model innovation techniques (white) with methods from strategic foresight (blue) to create a powerful journey for top management teams to develop winning business models that advance the status quo. The white elements build on the techniques introduced by Alex Osterwalder and Ives Pigneur (2010).

Five Strategic Foresight Tools to win on Business Model Innovation

Trend audit (assessment)

To execute the trend audit, we identify 3–5 trends driving change in the larger industry or sector in which the case is situated. The challenge here is to look beyond the scope of the current business by looking ten years or more into the future. After a brainstorming session to create a list of candidate trends, those that are deemed particularly important to the business model are selected and subjected to a “trend audit” that consists of four questions (Gordon, 2010):

- DRIVERS: What are the driving forces that create and sustain the trend?

- ENABLERS: What enables, catalyzes, or supports the drivers of the trend?

- FRICTION: What inadvertently stands in the way of the trend, slowing it down?

- TURNERS: What or who is working to actively block the trend?

Business model stress testing

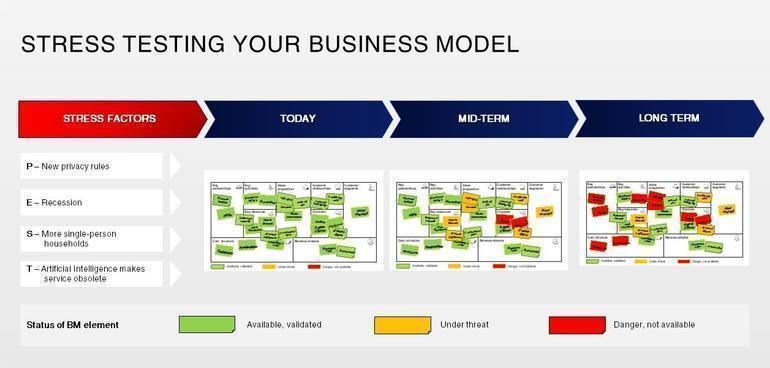

To stress-test the current business model, we apply an approach loosely based on Haaker, Bouwman, Janssen, and de Reuver (2017) that assesses a BM’s robustness in the medium term (5 years) and in the long term (10 years). We assess how each building block would perform under the conditions of the trends (stress factors) that they identified as being salient to their case. Colors are assigned to BM elements that reflect their viability, or the “level of stress”, that affects the BM elements. This results in a visualization that shows how the current, well-functioning business model will increasingly fail as trends unfold their disruptive force (see below).

The benefit of the stress test is the sense of urgency it creates and its intuitiveness. This helps to create the necessary buy-in from top management and relevant stakeholders.

Science fiction

In this step, science fiction vignettes, images, and states of the future are used to help think through radically different frames. We may use dystopias or utopias that often involve an exaggeration of current technological capabilities. These images challenge the status quo and current mental models by inciting fear or optimism and reframe our conceptualization of “how things work” (Peper, 2017). A group exercise to create a business model for a problem described for a fictitious future society can be facilitated. We use passages from science fiction novels and invite others to prototype a business model for a future use case (Schwarz and Liebl, 2013). As a primer, our students listen to the Gartner podcast with Brian David Johnson.

Forecasting future markets

The forecasting future markets block is used to create quantitative estimates about market sizes and analyze the financial viability of new business models. We start with creating a value formula and estimating the values for each variable. In the group, we discuss different approaches to estimate calculations and various ways of running estimate calculations (top-down, bottom-up, and explicit estimates). We aggregate these calculations using the principle of triangulation to produce a future market forecast.

BM Wind Tunneling

Wind tunneling builds on scenarios or trends to test how the business models will perform in different environments. It is important that the scenarios cover all plausible futures and that they are sufficiently distinct from the status quo without becoming unrealistic (van der Heijden, 1996). Here again, we leverage outputs from the trend audit and identify branching points in the trends that could result in different outcomes and implications.

Conclusion

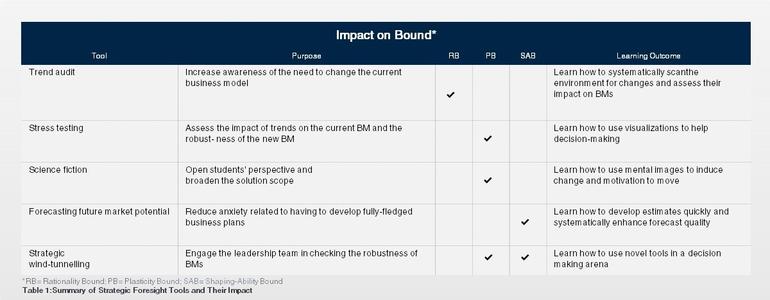

One of the major obstacles in BMI is the difficulty of breaking free from three main cognitive bounds (Gavetti, 2012):

- The rationality bound which results from dominant representations shared across an industry or sector, where managers, when assessing the world around them, fail to recognize more distant, radically innovative business opportunities.

- The plasticity bound which results from inertia. Or in other words, firms might fail to act on opportunities because they fail to understand that they could or might lack the resources or capabilities.

- The shaping-ability bound describes the inability to legitimize needed action, where managers fail to secure the necessary buy-in of stakeholders, such as board members or investors.

The table below shows how the five strategic foresight tools contribute to overcoming the three cognitive bounds.

From teaching this course for over eight years, I can confirm that the strategic foresight tools are powerful to enable and force participants to think outside the box, overcome groupthink and identify new strategic alternatives. In some courses, I have also expanded the wind-tunneling exercise to a full scenario-based strategizing approach, which includes the analysis of multiple strategies across multiple scenarios.

Author: René Rohrbeck

Co-authors: Christina Bidmon, Anna Holm, Matthew Spaniol