The Historical background of Corporate Foresight

For over 70 years, Corporate Foresight has been helping organizations to lay their foundation for future competitive advantage. In this insight, Prof Dr René Rohrbeck provides a brief recap on the history of Corporate Foresight, based on his article Corporate Foresight: An Emerging Field with a Rich Tradition, in which he gives an overview of the state of the art, major challenges, and identifies development trajectories.

Definition of Corporate Foresight

Since the birth of the field, there have been many popular definitions. The early definitions would conceptualize Corporate Foresight typically as a process, while the later definitions emphasize organizational integration, and some conceptualize Corporate Foresight as an organizational ability.

The definition by Rohrbeck, Battistella and Huizingh emphasizes the nature of Corporate Foresight as an integrated practice that permits an organization to steer towards and shape its desired future:

“Corporate Foresight permits an organization to lay the foundation for future competitive advantage. Corporate Foresight is identifying, observing and interpreting factors that induce change, determining possible organization-specific implications, and triggering appropriate organizational responses. Corporate Foresight involves relevant stakeholders and creates value through providing access to critical resources ahead of the competition, preparing the organization for change, and permitting the organization to steer proactively towards a desired future.”

History of Corporate Foresight

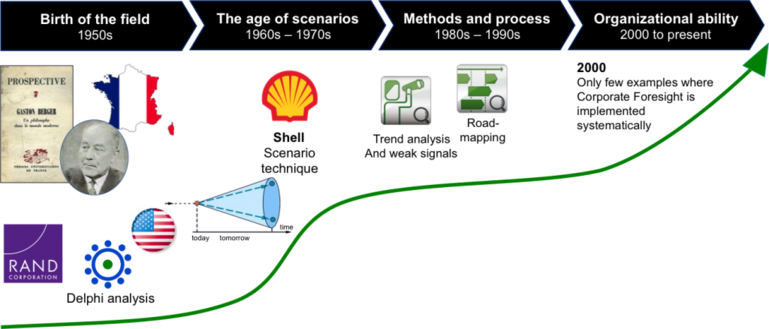

Historically we can distinguish four main phases.

1950s: birth of the field

Corporate Foresight emerged as a research stream in the 1950s. The new field had two main roots. The first was the French ‘prospective’ school, founded by the philosopher and high-level public servant Gaston Berger. The second was the ‘foresight’ school, based on the work of Herman Kahn at the RAND Corporation in the US. Both schools differ in their fundamental philosophy. While the ‘foresight’ school proposed sophisticated methods and was based on the idea that expert analysts would engage in foresight work, the ‘prospective school’ favored lean methods that could be applied collaboratively directly by the decision-makers.

1960s and 1970s: the age of scenarios

In the 1960s, the field of Corporate Foresight saw a variety of successful applications of its methodological and processual repertoire. In particular, the application of the scenario method by Royal Dutch/Shell triggered broad interest in Corporate Foresight methods. The planning team of Shell used the systematic approaches of foresight to identify two key change drivers: The depleting oil resources in the US and the deteriorating relations of the West to the OPEC countries. This resulted in Shell being the only major oil company prepared for the oil crisis that followed the Yom Kippur War. This success triggered the application of the scenario technique by a growing number of firms including Motorola, General Electric, and United Parcel Service.

1980 and 1990s: professionalization of methods and processes

In the 1980s, markets became increasingly saturated. Consequently, firms seeking superior positions in their markets needed to upgrade their business and corporate planning tools, and new Corporate Foresight methods emerged. Methods such as (technology) road mapping and continuous environmental scanning approaches emerged and were adopted by an increasing number of firms.

2000 and beyond: organizational integration

The implementation of Corporate Foresight processes has in many firms led to the creation of organizational routines that facilitate the development of future insights. However, many firms still report challenges in translating these insights into organizational responses. The fundamental dilemma seems to be twofold: on the one hand, a large variety of data sources have to be tapped into, and the resulting collections of quantitative and qualitative data require human interpretation by top managers to be effective. On the other hand, the limited time and attention span of top management prohibit sufficient exposure to the raw data.

In recent years, Corporate Foresight research and practice have focused increasingly on ways to integrate processes. Such an integrated approach would leverage distributed organizational sensing, interpretation, and planning capabilities. Corporate Foresight contributes through an orchestration role and fills the gaps left by existing functions, such as research & development, innovation management, strategic management, risk management, and corporate development.

Reach out to us for recent case studies and possible applications of Corporate Foresight in your company.