Air transport will never be the same again…

- Four drivers of change herald a radical transition in air transportation:

business travel, regionalization of routes, “star” networks, and flight shaming - The post-Covid scenarios will emerge around these four factors

- Studying these different possible scenarios will be the subject of the continuation of Professor Rohrbeck’s research project

“In less than 65 days, we have returned to the flight plan levels of 65 years ago. This is extremely bitter, devastating, and painful”. This was the observation made by Lufthansa CEO Carsten Spohr when he addressed the German company’s shareholders on 5th May 2020.

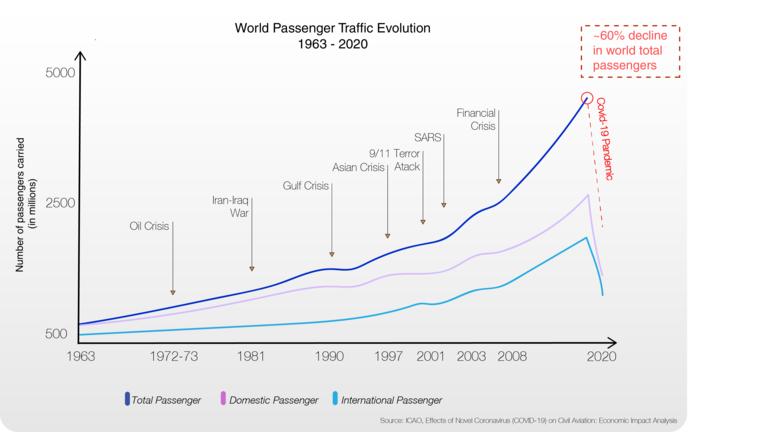

In spring 2020, Lufthansa’s number of passengers only amounted to 1% compared to 2019. This figure illustrates the scale of the crisis, as well as the gloomy global outlook for the aviation sector. The International Air Transport Association (IATA) predicts a 55% decrease in passengers worldwide compared to 2019, including months when traffic was still at a normal level.

Despite this unprecedented crisis in its intensity, a future without air transport remains unthinkable. For most of Professor Rohrbeck’s students, air travel is the only way to join the EDHEC campus and go back to their families; for many, it is a way to discover new cultures and make new friends and drive global understanding. It also has a strong role in supporting the global economy and fuel the growth of prosperity. Compared to any other global crisis, the one we are living in today has a stark contrast in its intensity in the history of air travel evolution. So, can the airline industry be saved? And if yes, how? And, what will it look like after the crisis?

Business travel, back to normal?

Perceived as an essential driver of economic growth, business travel has enjoyed the magical aura to transform physical meetings around the world into a business and economic opportunity for many years. It has also been an important growth engine for the airline industry. However, business travel may never return to its pre-crisis level.

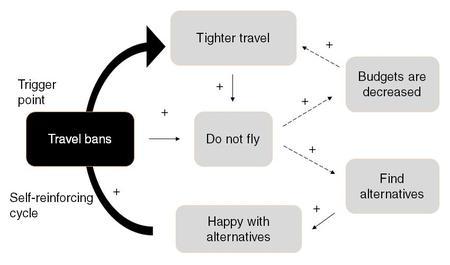

As the feedback chart below suggests, travel bans involve fewer (or no) flights, resulting in lower budgets and tougher travel regulations that may prevail even after travel bans have been lifted. If such a cycle is stopped within 4 weeks, new behaviors will not have time to adapt, and the system will generally return to its original state.

However, the longer the crisis, the more likely it is that systemic changes will become permanent. The lack of business trips and face-to-face meetings has led to the adoption of mass alternatives, such as video conferencing, virtual collaboration, online whiteboards, etc. If these alternatives can show that they can increase productivity, business travel would become an exception for meetings, as was the case 65 years ago.

From globalization to regionalization?

Since 2005, globalization has shown signs of slowing down. Business internationalization strategies are increasingly focused on local responsiveness and less and less on control and dependence on international headquarters. Global trade tensions, such as the U.S.-China conflict, may decrease intercontinental travel. The Covid-19 crisis could accelerate this trend and promote regional trade and supply.

A recent study showed that an important response to the Covid-19 crisis was the relocation of supply chains and, in particular, the emphasis on the use of regional ecosystems. This response could become permanent, reinforced by the low level of international travel. Recent figures from the International Civil Aviation Organization (ICAO) show that while inter-regional travel has picked up from an average of 250 million passengers before the crisis to 100 million today, the number of international passengers is 20 million, well below the pre-crisis 160 million.

The end of the hub & spoke model?

It is interesting to note that the impact of the Covid-19 pandemic has been felt differently by low-cost airlines such as Ryan Air or EasyJet, and traditional network airlines (CATR), such as Air France, Lufthansa or Singapore Airlines. CATRs rely on central platforms where short-haul flights are connected to long-haul flights that are more economically attractive with their larger aircraft capacity. This hub-and-spoke model also creates powerful network effects, allowing major airlines to achieve economies of scale and create powerful entry barriers for newcomers.

These benefits for CATRs, however, come at the cost of passenger acceptance. Indeed, these routes involve connections. Normally, this can be called into question for environmental reasons and may be perceived as an inconvenience by passengers. But in times of health crisis, hubs are key risk areas in passenger travel, as it remains difficult to guarantee standards of social distance at airports. The interdependence between short-haul and long-haul flights is also a huge obstacle to recovery. For CATRs, the absence of long-haul flights means that short-haul flights must be reduced. The absence of short-haul flights will make it impossible to fill large long-haul flights. Low-cost, full-service airlines operating a point-to-point model can be much more responsive in opening and closing routes to meet fluctuating demand. Most CATRs have a strategy to hold on and eventually restart their hub-and-spoke model. But to avoid a breakdown of their long-haul refueling system, they must keep open roads that are not profitable. This makes them, in most cases, dependent on state aid. The question is how long this strategy can be maintained and how long taxpayers will be willing to cover the losses.

It’s no wonder that some CATRs are rediscovering holiday travel with their point-to-point offerings. “Never before have we included so many new holiday destinations in our program. This is our response to the wishes of our customers,” explains Harry Hohmeister, a member of the board of directors of Deutsche Lufthansa AG.

And what about flight-shaming?

The growing awareness of the environmental impact has led to a flygskam (flight shaming) movement in Sweden to avoid air travel that has now gone far beyond the kingdom’s borders.

However, there are also signs that containment-related measures, in response to Covid-19, have increased citizens’ desire to adopt a calmer lifestyle. This raises questions about the cosmopolitan way of life that the middle classes have so easily adopted. This point remains at the heart of aviation players’ concerns, even if its real influence on consumer behavior remains difficult to measure.

The article was originally published in French by The Conversation

In September 2020, EDHEC Business School launched a project on the future of the air transport industry. As part of this project, 13 partners from the airline ecosystem are supported in using different forecasting methods to study scenarios for this industry’s future.

Join our two upcoming sessions on

The Future of Air Travel – Challenges and Solutions (December 11th, 10.00-11.00 CET)

The Future of Air Travel – Scenarios and their Desirability (December 11th, 13.00-14.00 CET)